Whether your farm is large or small, you’ll want to protect your investment with the right kind of farm insurance.

Whether your farm is large or small, you’ll want to protect your investment with the right kind of farm insurance.

Standard coverages available under a farm policy include property damage coverage and liability coverage.

- Property damage coverage protects your farmhouse, outbuildings or household belongings if they are damaged or destroyed by the unexpected consequences of a fire, hail storm or tornado .

- Liability coverage pays for damages if you unintentionally cause injury to another person, or if you unintentionally cause another person’s property to be damaged or destroyed .

Farm machinery, crops, livestock– can all be insured in a number of different ways.

IF you have employees working on your farm, you may need to purchase workers’ compensation coverage . To be certain you obtain proper coverage and an accurate quote, you should have a list of all your employees, their titles and a description of the work they perform, as well as the number of hours they work and the wages they earn, with a summary reflecting the total number of employees and the total payroll .

More and more farmers are turning to agri-tourism. If your business includes these types of operations, make certain you have the appropriate type of insurance and the appropriate amount of liability coverage to protect you in the event someone becomes sick or injured while on your property .

If you operate businesses at your farm, including a farm stand, hayrides, pumpkin patches or corn mazes or you host events such as parties or weddings– you may need a business policy as opposed to a farmowners policy . If you sell particular products, such as jams, pies, fruits or vegetables, consider purchasing a policy to provide you with product liability coverage . The best way to be certain you have the proper insurance in place and to protect yourself against losses before they happen is to have your insurance agent walk around with you to inspect it and discuss in detail your farm operations .

Remember it is important to conduct periodic self-assessments to evaluate any safety risks. Your insurance agent can help provide the professional resources to help you assess risk.

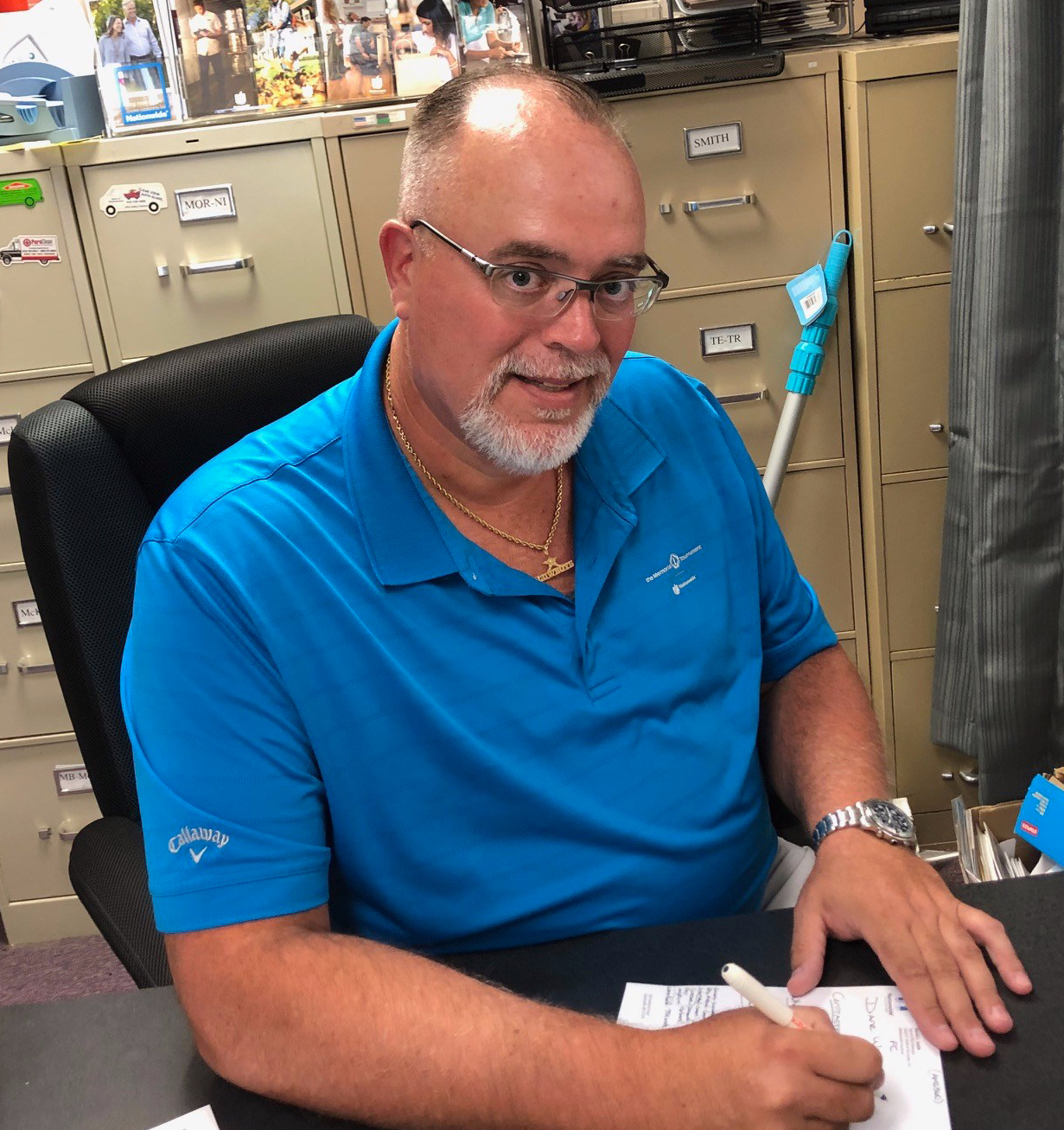

Today’s farmers and agri-business owners need a suite of insurance products designed to protect their hard-earned investments. At Crilly Insurance, we can provide the coverages you need.

We can provide you with affordable Farm Insurance solutions. Call us at 410-571-1771 for a full evaluation of your Farm Insurance needs.

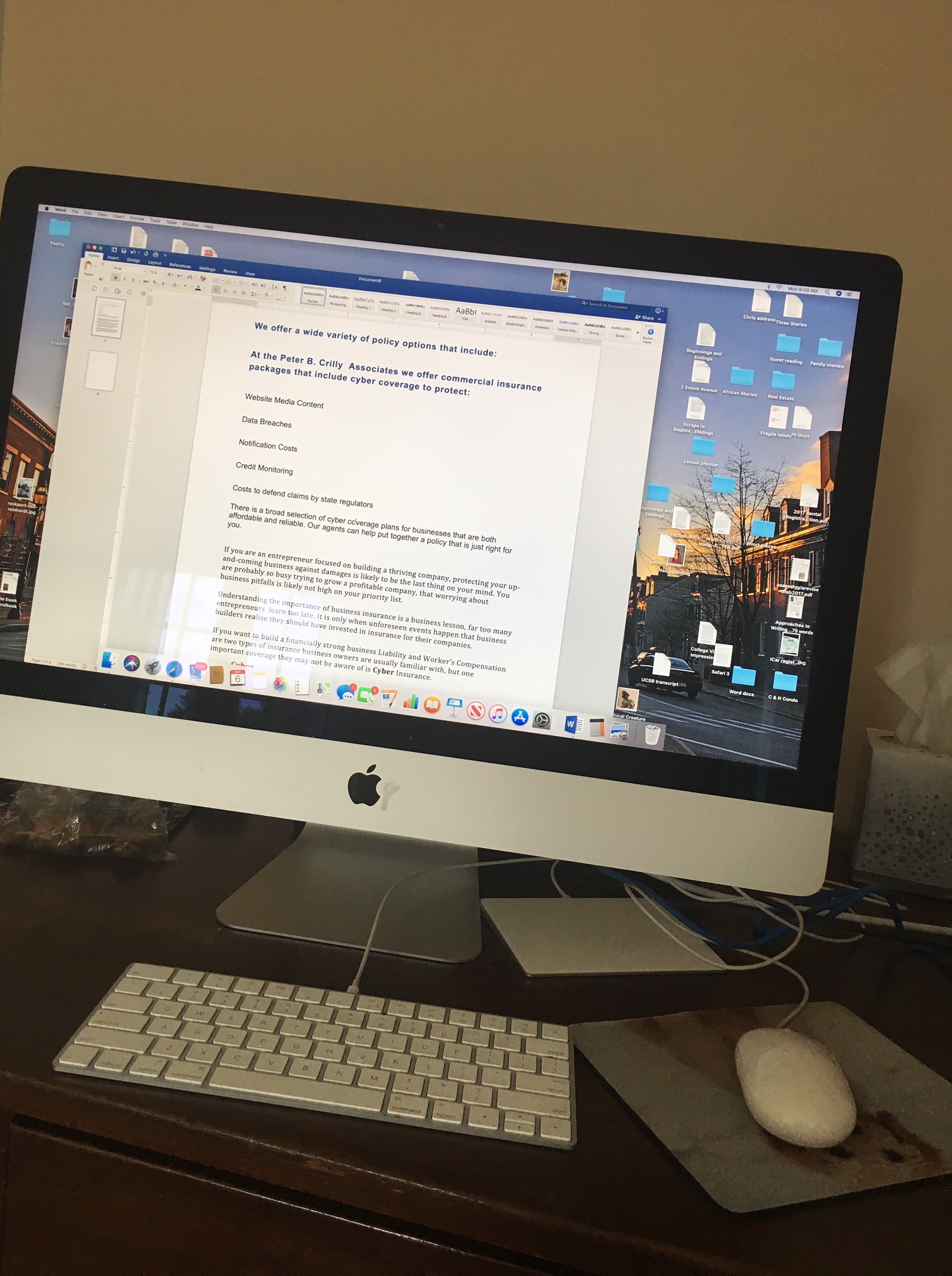

Cyber- crime is a growing threat to both large and small companies. You may think your business won’t be targeted, but criminals won’t care if you are an entrepreneur building a small business or launching a startup company. The funds you spend to invest in cyber security measures and damage/vandalism insurance is an expenditure you won’t regret.

Cyber- crime is a growing threat to both large and small companies. You may think your business won’t be targeted, but criminals won’t care if you are an entrepreneur building a small business or launching a startup company. The funds you spend to invest in cyber security measures and damage/vandalism insurance is an expenditure you won’t regret.